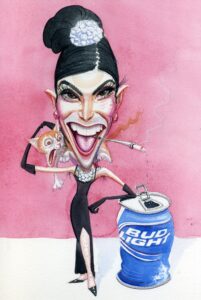

While missed by some, but understood by all, BlackRock CEO Larry Fink recently announced his transition. Lacking the lipstick and whimsy of the Dylan Mulvaney transition announcement (think Bud Light), but requiring the same suspension of reality, Fink’s announcement was far more unbelievable. “I’m ashamed of being part of this conversation,” Fink said during an interview last Sunday, at the Aspen Ideas Festival.

Referring to the debate and growing discord about the environmental, social and governance (ESG) reporting and scoring construct that pervades Wall Street and increasingly impedes Main Street, Fink is trying to distance himself from the three letters E-S-G, that describe the construct, while maintaining his rabid support of the concept itself. While the letters are upsetting to him, he remains a loyal advocate of the change it portends. “I’m not going to use the word ESG because it’s been misused by the far left and the far right,” he asserted.

Claiming that ESG has been “weaponized” and that it has become “too politicized,” he has seemingly forgotten why the acronym was created in the first place, and by whom. Weaponization and politicization are central to the entire initiative. But like with most transitions these days, Fink is focused on the word, not the reality. Whether it’s called decarbonization or conscientious capitalism, as he suggests, matters not at all. He remains as strident as always in his commitment to ESG’s purpose. Like Mulvaney, changing a name doesn’t change the fundamental anatomy of what is ultimately a destructive effort to remake society.

Definitely not Dylan Mulvaney,

The ESG scheme is the brainchild of Neo-Marxist and World Economic Forum (WEF) Founder, Klaus Schwab. It was launched more than two decades ago and has since infected large swaths of corporate America. An aggressively political globalist who values control (his) above all, Schwab has led the methodical initiative of network-building of non-profits, NGOs, governments, and corporate financial sector partners, including Fink’s BlackRock. Each of the entities are vital players in the shaping of business, social and political agendas through a validation feedback loop that has one primary purpose.

Using the narrative of imminent environmental destruction and social injustice as the motivating purpose, and the ESG fantasy as the overriding mechanism, the network seeks to wrest control of investor capital and redirect it to the companies, technologies and industries that help achieve the political and social objectives that Schwab, Fink and their like-minded cohorts deem important to their world view and to themselves.

So aligned with this effort is Fink that he sits on the WEF Board of Trustees, to which the genesis of the ESG scheme can be unequivocally traced. Further, Fink has repeatedly articulated the WEF mission vis-a vis alleged benefits of ESG in his now numerous and infamous “Letters to CEOs.” Put another way-- the person [Fink] -- who helped hone and politically promote ESG now wants to transition away from the term “ESG” and toward phrases like “decarbonization” and “conscientious capitalism” because ESG has become “too politicized.” But like Mulvaney, it takes more than words to change what’s underneath Fink’s ESG trousers.

Knowing they could never achieve the political and social change they seek through traditional democratic means, the “ESG/ Decarbonization/ Conscientious Capitalism” (DCC) neo-Communist scheme, offers them the cover they seek---or so they thought. The re-orienting of investor dollars was supposed to happen without notice of investors, pension funds, elected officials or the broader market. Enter Fink’s “politicization” reference. As investors, industry leaders, and the market have become aware of the real-life impact of ESG-related pronouncements and policies, they've finally begun to push back, rejecting both the premise of "environmental catastrophe" and social injustice and the mechanism itself. What Fink describes as “politicization,” others might call rejection.

Recognizing that ESG scores translate into access to much needed capital at the corporate level, many now understand that a reporting and scoring scheme that demands behavioral adherence by everyone except the advocates themselves will eventually bleed over from publicly traded companies to private industry and ultimately to the individual, threatening each citizen's own access to capital, products and services. As self-ascribed arbiters of permissible behavior, folks like Fink & Co. envision a day where their social and political priorities are the only acceptable paths to participation in the market and in society.

Definitely not Larry Fink.

The result? Incandescent light bulbs, a world-changing invention by Thomas Edison that brought light into homes across American in the 1880’s have now been deemed illegal to manufacture under the Biden administration. Apparently more dangerous than even fentanyl, the administration supports a monetary punishment for manufacturing incandescent light bulbs. Beginning next month, manufacturing incandescent lights bulbs will carry a fine of up to $542 per bulb. How did a government unilaterally make incandescent light bulbs illegal? So focused on controlling purchasing decision are they, that we are forced to buy inferior products dictated by bankers and activists.

Similarly, in Washington State and California, local governments have madeillegal natural gas stoves and natural gas as an energy source. Claiming that they lend to "climate change" while offering no scientific evidence, banning a product that the broader market wishes to purchase, the decarbonized and conscientiously capitalistic world of the future becomes more clear… or at least more clearly dystopic. Live by the values the policy police demand or one’s existence will include a diminished decarbonization score—impeding you from fully participating in society. Whether limited access to certain places, or stripped of privileges of a formerly free society, people are transformed into lab rats in the bankers labyrinth. If this scheme remains unimpeded, people will be living by decarbonization rules, rewards and punishments doled out by those who themselves are not similarly constrained.

So as Fink embarks on his newly announced "transition" away from ESG, he should be reminded that for those for whom self determination matters, tyranny looks the same no matter how it's dressed up or what it's called.

Article tags: BlackRock, Bud Light, Dylan Mulvaney, ESG, Klaus Schwab, Larry Fink, World Economic Forum

Gates and Schwab want a monopoly on all our food and therefore they should both banished from America for life and even longer

It’s worse than you say. After remodeling our guest bathroom a few months ago, I had the opportunity to reflect on the following: A new dimmable LED bulb w/dimmer switch to control it runs around $32. That’s around $24 more than an incandescent bulb w/ an incandescent dimmer switch (because incandescent bulbs and “rheostat” dimmers are less complicated). Since I estimate that we use the guest bathroom lighting (total 51 watts as LED or 360 watts incandescent equivalent) no more than 12 hours per year, and since electricity here on the left coast averages around $0.25 per kWh, the LED bulbs save me about 93 cents per year to operate. BUT, since the upfront cost of the LED/dimmer combo is $24 more than the incandescent equivalent, it will take over 25 years to recoup my upfront cost and start realizing the operational benefit of LEDs. THAT’S what is wrong with central planning.

.

For tomorrow’s lesson, we will discuss the absurdity of electric vehicles, with their upfront price point premium of approximately $20,000.