JPMorgan Chase CEO Jamie Dimon finally said the quiet part out loud when he suggested in his Annual Letter to CEO’s that there must be a coordinated alignment by government, corporations, and non-government organizations (NGO’s) to implement what he describes as practical policies to expedite the move to a transitioned, net-zero world. For Dimon, this includes using eminent domain to confiscate private property for the construction of wind and solar projects. Perhaps unintentionally, Dimon also affirmed what many market watchers have been asserting for some time—that there is an fundamental lack of interest by the market for a net-zero, "transitioned" world.

Described as a power of federal, states, and municipalities government to seize private property for public use while compensating the owner at "fair market rates," Dimon’s interpretation doesn’t focus on public use. His interest pertains to returns, distributions, and control.

In his letter Dimon explains that he wants to direct capital flows toward "green," transition-centric businesses and industries, many of which do not currently exist, in order to expeditiously usher in a society that investors manifestly do not want. All while ignoring the reality that by moving toward such a world, America and other western democracies would necessarily become more dependent on China, America’s most sinister economic adversary.

Give the Chinese what they want.

Because of the quantity of rare-earth elements that China controls, a dependence on China to produce the energy and products of a net-zero world would bind American investors to an antithetical Communist regime that hates individual liberty and seeks to harm America. Forcing a move to technologies whose inputs America does not control, to create a society investors do not want, risks the economic sustainability that used to be a foundation of sound corporate investing. A transitioned, net-zero world therefore is not possible if liberty, economic stability, and democratic institutions are to remain pillars of American society.

But Dimon persists:

To expedite progress [of the green agenda], governments, businesses and non-governmental organizations need to align across a series of practical policy changes that comprehensively address fundamental issues [investors and democratic institutions] that are holding us back. Massive global investment in clean energy technologies must be done [through forced capital re-orientation] and must continue to grow year-over-year… We may even need to evoke eminent domain — we simply are not getting the adequate investments fast enough for grid, solar, wind and pipeline initiatives.

For your own good, comrade.

Note his liberal use of the word must, a typical Leftist trope/demand. Dimon, however, isn’t alone in his desire to bum-rush America onto the net-zero version of the Titanic. The prospect of large-scale compulsory seizure of land for wind projects was recently highlighted in future energy scenarios presented by oil giant Shell as a possible necessity for an accelerated push to net-zero.

As CEO of one of the largest financial conglomerates in the world, Dimon is supporting the vision and strategy of the World Economic Forum (WEF). If, as it appears, the WEF is using Dimon to promote its political and social agenda, it would place JP Morgan Chase in conflict with its legal obligations to investors as described by the sole interest rule and codified in U.S. law.

In 2000 the WEF began to establish a network of governments, NGOs, and large publicly traded corporations from the financial sector to re-orient the capital markets through capital allocation decisions made in the board rooms of corporate America. Support the political and social objectives of the WEF known as environmental, social and governance (ESG) goes the argument, and capital is invested in your company. Believe that your company should focus on meritorious delivery of products and services and not focus on political and social objectives and capital is withheld. Placing an ideological thumb on the scale of capital allocation decisions has become a problem for all investors that increasingly exposes JPMorgan Chase to legal challenges and market implications.

Dimon’s suggestion that taking private property for the financial benefit of private companies defies rational thinking. Perhaps Dimon is trying to recover from what many might consider the bad bet he made with the WEF as a member company.

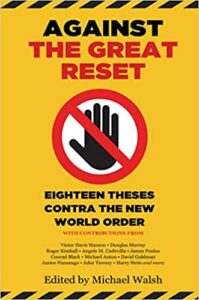

Now on sale.

The “Great Reset-ers” from WEF promised the largest asset management firms, including JP Morgan Chase that for their participation in the capital re-orientation scheme intended to fund the tracking and surveillance technologies and companies needed for the net-zero world, Dimon and his cohorts would benefit financially through higher management fees and equity positions in such newly funded companies.

But in the face of the market's potential rejection of the surveillance state that such technologies and companies would pose to personal liberty and democracy, Dimon now calls on government to force via confiscation that which investors do not want to fund. The financial sector "net-zero sure-thing,” it seems, is being threatened, and Dimon is in a bit of a “net-nothing” panic.

While not a direct acknowledgement of a market rejection of the green agenda, Dimon’s letter acknowledges that the ESG scheme created by the WEF hasn’t been able to successfully re-orient sufficient capital to achieve the political and social change he and the other WEF activists seek. Let's hope they never do.

Article tags: China, ESG, Jamie Dimon, Liberty, net-zero, woke capital

Eco-Freaks Ten Comandment's Though Shalt Not Drive Car, Though Shalt Not Eat Meat, Though Shalt Not use Fossil Fuels, Though Shalt Go Vegan Though Shalt Worship Gaia, Though Shalt Not cut down Trees, Though Shal Worship the Creation, Thou Shalt only celebrate Earthday Though Shalt Not Have Children

Modern-day Catholic indulgences. It’s good work if you can get it.