Earlier this month the Human Rights Campaign along with other LGTBQ+$$ activist organizations penned a letter to the CEOs of social media companies, asking them to silence people with views with which the radicals of the HRC disagrees. Seeking to achieve through censorship that which they have not been able to achieve with open discourse, the group approached Facebook, Instagram, YouTube, TikTok, and even Twitter, proposing a collaboration of sorts in order to achieve what these activist authors describe as “better enforcement of hate speech, harassment, misinformation, and other existing content policies aimed at protecting transgender, nonbinary, and gender non-conforming users and all LGBTQ+ people.”

The censorship the HRC asks of the social media companies comes in the face of the Bud Light and parent company Anheuser Busch’s Dylan Mulvaney trans-gender marketing disaster that has resulted in the tanking of Bud Light’s market share, its share price and its market valuation. What makes the situation particularly interesting is that it provides a real-time example of how the environmental, social and governance (ESG) reporting and scoring eco-system actually works,--- and seems to indicate that consumers are finally pushing back.

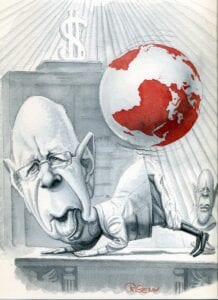

The Great Dictator.

The genesis of ESG starts with the treacherous cartoon villains of the World Economic Forum (WEF). As previously explained the WEF, founded and still led by neo-national-socialist Klaus Schwab and his investment-bank member corporations including BlackRock, are the progenitors and leading advocates for a single global government through which they seek to control every aspect of society, while simultaneously enriching themselves and the corporations and technologies in which they invest.

Far from wanting to use their own capital, however, they needed a way to force investor capital toward their favored corporations and technologies necessary for the surveillance and tracking objectives of their one-world vision. Enter the now infamous ESG -- "Environmental, Social, and Governance" -- scoring system. It is the mechanism they created to catalyze the societal change they seek. --- Have a high “good” ESG score and capital is made available from investment banks. Choose as a company to focus on delivering the best product or service instead of ESG scores and vital capital will be withheld by these arbiters of ambition.

Having successfully made many corporate CEOs their ESG bitches, Schwab and investment bank partners like BlackRock needed one more element to round out their one-world ménage à trois. Enter non-profit activist organizations such as the "Human Rights Campaign." They represent the “social” in the E-S-G scoring framework. With the pressure to increase their ESG score driven from boardrooms controlled by WEF member investment banks like Blackrock, State Street and Vanguard -- activist organizations including HRC were invited in to take part in the now-familiar corporate shakedown.

Peddling the sensitively and diversity training flavor of the week, these C-Suite "thought leaders" already know the steps of this social justice jitterbug. More commonly known as “diversity, equity and inclusion” (DEI), it is the ESG training curriculum to "enlighten" employees by berating, denigrating, and humiliating them. Buying the DEI training that these non-profit justice warriors are selling rounds out the three-legged stool sample that constitutes the ESG eco-system.

Ménage-à -LGTBQ+$$

Be a good steward of the WEF globalist vision as represented in ESG, even if at the expense of investor returns, and one’s ESG score gets raised and access to capital is granted. But fail to follow these ideological pied pipers and access to capital is denied as the ESG score tumbles. Whether compliant, uninterested, or just plain ignorant, most CEOs at publicly-traded companies have willingly joined the lucrative ESG validation feedback loop that now permeates corporate America.

Considered the largest LGBTQ+ political lobbying organization in the U.S., the HRC used to advocate for gay marriage and other gay issues. But with gay marriage realized in 2015, and employment non-discrimination in June 2020, the HRC became a non-profit without a cause… or so we thought. According to the Wayback Machine, the HRC made a pivot starting during the last quarter of 2020. No longer interested enough in gay rights to fight for gays in places like Syria, where in 2015 a man was hurled from building rooftop for purportedly being gay, these LGTBQ+$$ warriors needed something with more pizazz than could be delivered by such pedestrian concerns.

So HRC opted for a new schtick—one with lots of makeup and silicon. The problem was, they found themselves competing for their piece of the corporate shakedown pie with another avatar of social victimhood: the now disgraced, though well-housed bonzes of Black Lives Matter, Inc. With fists held high, HRC spent the summer of 2020 with the Antifa building-burners at "mostly peaceful" protests promoting their new-found purpose. The transgender shakedown of corporate America had begun.

Not valid in all political entities.

With the winds of ESG at its back and the “fear of missing out,” HRC sprang into action—even changing its mission to match the moment: “Our goal is to ensure that all LGBTQ+ people, and particularly those of us who are trans, people of color and HIV+, are treated as full and equal citizens within our movement, across our country and around the world," except of course for the Middle East.

But now, despite the globalists’ coordination and corporate collaboration, the winds are changing. As Bud Light just learned, sometimes experiments have unpredictable outcomes. Conceived of and initiated by some of the nastiest globalists at the WEF and greedy opportunists on Wall Street, their coordinated efforts to dismantle democratic institutions using ESG to re-orient the capital markets has hit an unexpected impediment: customers. The individual, it seems, has more power than the powerful perceive. While a single individual can change the course of a county's history, groups of them can unravel even the best laid global plans for destroying society.

Just ask Dylan Mulvaney and Alissa Heinerscheid.

Article tags: BlackRock